US nonfarm payrolls declined by 92,000 in February 2026, unemployment rate rose to 4.4% in February 2026

03/07/2026 12:00 pm EST

AJ Economy Trend - United States Down due to decline of nonfarm payrolls by 92,000 and rise of unemployment rate to 4.4% in February 2026

U.S. nonfarm payrolls declined by 92,000 in February 2026, marking the largest job loss in four months and significantly underperforming expectations of a 59,000 increase. The drop followed a downwardly revised gain of 126,000 jobs in January, indicating weakening momentum in the labor market. Job losses were broad-based across several sectors. Health care employment fell by 28,000, largely due to strike activity, with physicians’ offices losing 37,000 jobs, partially offset by 12,000 new positions in hospitals. Additional declines occurred in manufacturing (-12,000), transportation and warehousing (-11,000), information (-11,000), and the federal government (-10,000), continuing recent downward trends in those industries. In contrast, social assistance added 9,000 jobs, driven primarily by individual and family services (+12,000). Revisions also lowered prior employment figures, with December revised down by 65,000 to -17,000 and January revised down by 4,000 to 126,000, bringing the combined total 69,000 jobs lower than previously reported. Overall, the data suggest the U.S. labor market weakened in early 2026, following minimal net job growth throughout 2025.

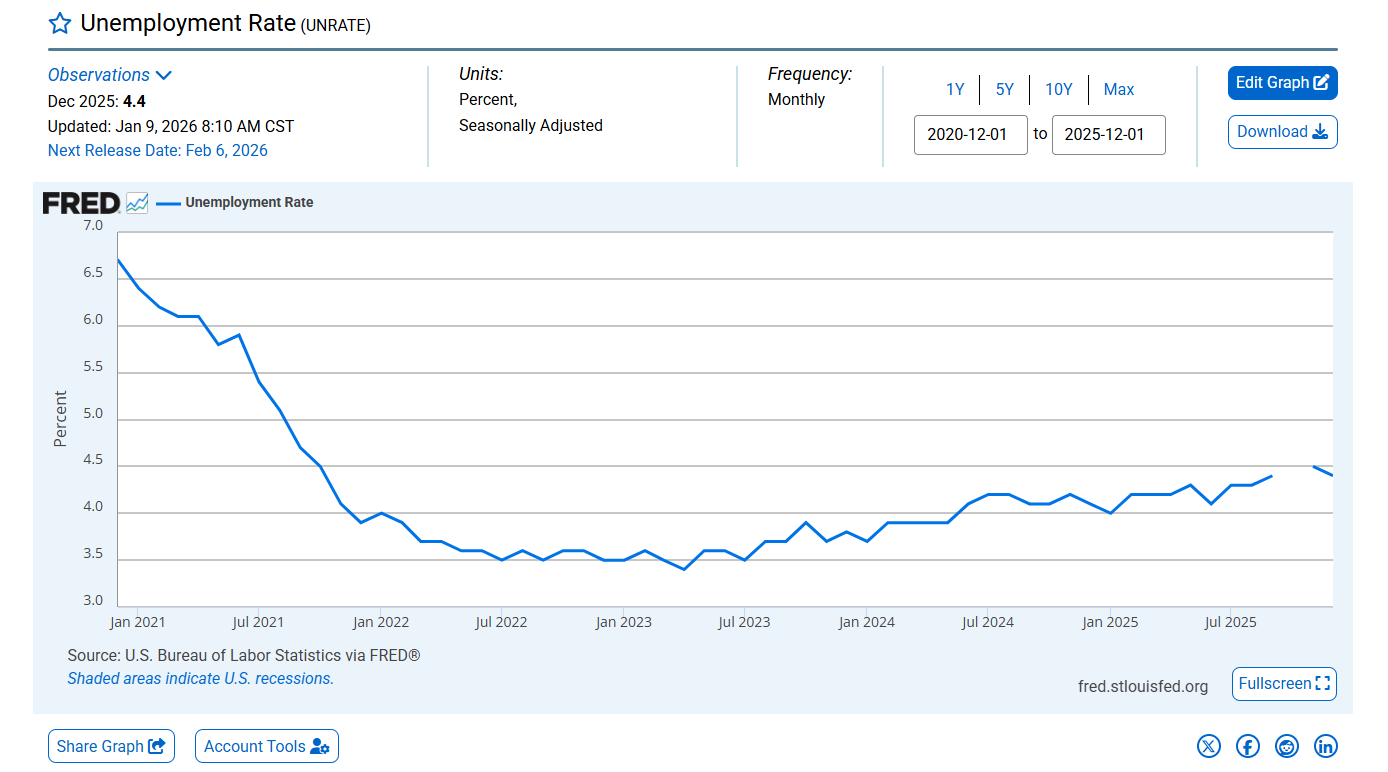

The U.S. unemployment rate rose to 4.4% in February 2026, up from 4.3% in January and slightly above market expectations, moving closer to November’s four-year high of 4.5%. The number of unemployed individuals increased by 203,000 to 7.57 million, while total employment declined by 185,000 to 162.91 million, signaling some softening in labor market conditions. The labor force expanded modestly by 18,000 to 170.48 million, though the labor force participation rate slipped to 62.0% from 62.1%. Despite the rise in the headline unemployment rate, broader labor market slack improved slightly, as the U-6 unemployment rate, which includes discouraged workers and those working part-time for economic reasons, fell to 7.9% from 8.1%. Overall, the data point to a modest deterioration in headline labor market conditions, although underlying measures of underemployment showed some improvement.

Initial Jobless Claims held steady at 213,000 in the final week of February 2026

03/06/2026 12:00 pm EST

AJ Economy Trend - United States Down due to rising continuous jobless claims that rose by 46,000 to 1.868 million

U.S. initial jobless claims held steady at 213,000 in the final week of February, slightly below market expectations of 215,000 and remaining well below the average levels seen over the past two years. The data suggest layoffs remain limited, reflecting continued stability in the labor market. However, continuing jobless claims, a measure of the number of people still receiving unemployment benefits, rose by 46,000 to 1.868 million, exceeding forecasts of 1.85 million. This increase indicates that while layoffs remain low, it may be taking slightly longer for unemployed workers to find new jobs amid slower hiring activity. Meanwhile, initial claims filed by federal employees declined by 25 to 529, easing concerns about the labor-market impact of recent government shutdown developments. Overall, the figures point to a labor market characterized by low firing but gradually moderating hiring momentum.

RealClearMarkets Optimism Index declined to 47.5 in March from 48.8 in February 2026

03/06/2026 12:00 pm EST

AJ Economy Trend - United States Down due to Optimism Index declined to 47.5 in March 2026

The RealClearMarkets/TIPP Economic Optimism Index for the United States declined to 47.5 in March 2026 from 48.8 in February, falling short of market expectations of 50.1 and remaining below the neutral 50 level that separates optimism from pessimism. The decline was driven by weaker sentiment across several components. The Six-Month Economic Outlook, which gauges consumer expectations for the economy over the next half year, slipped 1.8% to 43.0 from 43.8 in February. The Personal Financial Outlook, reflecting how Americans view their own financial prospects over the next six months, dropped more sharply by 4.6% to 54.3 from 56.9. Meanwhile, Confidence in Federal Economic Policies edged lower to 45.1 from 45.7, indicating continued skepticism toward government economic management. Overall, the data suggest consumer optimism weakened in March, highlighting ongoing concerns about economic conditions and future policy effectiveness.

Japan’s labor market weakened slightly in January 2026, unemployment rate rose to 2.7%, above 2.6% market expectation

02/27/2026 12:00 pm EST

AJ Economy Trend - Japan Down due to rising unemployment rate to 2.7%, above 2.6% expectation and levels recorded in the previous 5 months

Japan’s labor market weakened slightly in January 2026, with the unemployment rate rising to 2.7%, above both the 2.6% market expectation and the levels recorded in the previous five months, marking the highest rate since July 2024. The number of unemployed individuals increased by 60,000 to 1.91 million, the highest level in four years. At the same time, employment declined by 290,000 to 68.17 million, while the labor force fell by 210,000 to 70.08 million, a five-month low. The number of people outside the labor force rose by 170,000 to 39.45 million, reaching a four-month high. Despite these shifts, the labor force participation rate stood at 63.5%, lower than 63.9% in December but higher than 63.2% a year earlier. Meanwhile, labor demand softened slightly, as the jobs-to-applicants ratio held at 1.18, marginally below both December’s level and market estimates of 1.19, indicating that while Japan’s labor market remains relatively tight, conditions have eased modestly at the start of 2026.

Weekly initial unemployment claims data ending February 21 showed a modest uptick in layoffs

02/27/2026 12:00 pm EST

AJ Economy Trend - United States Down due to higher initial jobless rate along with 4-week average initial jobless claims

Weekly initial unemployment claims data for the week ending Feb. 21 showed a modest uptick in layoffs but little evidence of broad labor-market stress. Seasonally adjusted initial claims rose to 212,000 (up 4,000), while the 4-week average edged higher to 220,250, keeping the trend in the low-to-mid-200k range. On the back end, continuing claims (insured unemployment) fell to 1.833 million (down 31,000) and the insured unemployment rate held at 1.2%, though the 4-week average of continuing claims increased to 1.848 million, suggesting reemployment remains only gradual. In unadjusted terms, initial claims dropped to 193,107 (down 16,723) and unadjusted continuing claims declined to 2.151 million (down 50,366), consistent with seasonal post-holiday normalization. Federal-program activity eased on initial filings (UCFE 554, UCX 428), while all-program continued claims were essentially flat at 2.239 million. State details showed no major increases; the largest declines in filings were concentrated in New York and Pennsylvania, and the highest insured unemployment rates remained in Rhode Island, New Jersey, and Massachusetts.

United State Bank’s Unrealized Losses show several banks with unrealized losses exceeding 50% of Common Equity Tier 1 capital

02/24/2026 12:00 pm EST

AJ Economy Trend - United States Down due to high risk in large percentage of unrealized losses from big banks such as Bank of America and Charles Schwab

The latest U.S. Banks’ Unrealized Losses Screener highlights a group of regional and community banks carrying substantial unrealized losses on their investment securities portfolios relative to Common Equity Tier 1 (CET1) capital. These losses reflect the sharp rise in interest rates over the past several years, which reduced the market value of long-duration bonds and mortgage-backed securities accumulated during the low-rate period.

Among the most exposed institutions, several banks show unrealized losses exceeding 50% of CET1 capital, meaning that if those losses were realized, a majority of their core equity buffer would be wiped out. Most notably, Union County Savings Bank (NJ) shows losses equal to 133% of CET1 capital, indicating unrealized losses exceed its core capital base. Other highly exposed banks include CB&S Bank (AL), Independence Bank (KY), and Green Dot Bank (UT), each with losses ranging between roughly 60% and 77% of CET1 capital.

Larger institutions such as Bank of America and Charles Schwab Bank report far larger dollar losses—$87 billion and $11.9 billion respectively—but their losses represent a smaller proportion of capital (roughly 38–44%), reflecting stronger capitalization and broader balance sheet diversification. While sizable, these ratios are materially less destabilizing than those seen at several smaller banks.

Importantly, most of these losses remain unrealized and largely concentrated in held-to-maturity (HTM) portfolios. As long as securities are not sold prematurely, losses do not directly erode regulatory capital for most non-advanced-approach banks. However, elevated loss-to-capital ratios increase vulnerability to liquidity stress or deposit outflows, as forced asset sales would crystallize capital impairment.

Overall, the screener shows that while the broader banking system remains functioning, a subset of smaller and mid-sized banks continues to carry significant interest-rate–related balance sheet pressure. The risk is not uniform across the industry, but concentrated among institutions with thinner capital buffers and heavier duration exposure.

United State’s economy expanded an annualized 1.4% in Q4 2025, the least since Q1 2025, well below forecasts of 3%

02/23/2026 12:00 pm EST

AJ Economy Trend - United States Down due to GDP increased 1.4% only in Q4 2025, below forecasts and with consumer spending slowed consistently

The US economy expanded an annualized 1.4% in Q4 2025, the least since Q1 2025, following a 4.4% growth in Q3 and well below forecasts of 3%, the advance estimate showed. Consumer spending slowed (2.4% vs 3.5%), weighed down by a 0.1% decline in goods purchases, while services spending rose 3.4%. Meanwhile, exports fell 0.9% after surging 9.6% in Q3, and imports also declined, though at a slower pace (-1.3% vs -4.4%). Government spending and investment contracted sharply by 5.1% (vs 2.2%), subtracting 0.9 pp from overall growth, due to the government shutdown. On the other hand, fixed investment accelerated (2.6% vs 0.8%), driven by strong gains in intellectual property products (7.4% vs 5.6%) and equipment (3.2% vs 5.2%), as well as a more moderate decline in structures (-2.4% vs -5.0%). The drop in residential investment also eased (-1.5% vs -7.1%). Considering full 2025, the US economy expanded 2.2%, below 2.8% in 2024, reflecting increases in consumer spending and investment.

Canada’s retail sales are estimated to have rebounded 1.5% month over month in January 2026, showing mixed retail environment

02/22/2026 12:00 pm EST

AJ Economy Trend - Canada Neutral due to mixed retail sales result with overall growth but with regional drop of retail activity

Canada’s retail sales are estimated to have rebounded 1.5% month-over-month in January 2026, marking what would be the strongest monthly increase since December 2024 and reversing December’s 0.4% decline, according to advance data. In December, total sales fell to C$70.0 billion, with declines in three of nine subsectors, led by a 1.6% drop in motor vehicle and parts dealers. Core retail sales, which exclude gasoline stations and motor vehicle dealers, slipped 0.3%, signaling underlying weakness in discretionary spending. Gains in December were concentrated in gasoline stations and fuel vendors (+2.8%) and sporting goods, hobby, musical instrument, book, and miscellaneous retailers (+1.0%), while building materials, garden equipment, furniture, and home electronics posted the steepest contractions. Sales declined in seven provinces, with Alberta recording the largest drop (-2.1%), partially offset by a 0.6% increase in Quebec. On a year-over-year basis, retail sales in December were essentially flat, underscoring a mixed consumer spending environment despite the anticipated January rebound.

Initial jobless claims fell 23,000 to 206,000 but continuing claims rose by 17,000

02/21/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to initial jobless claims dropped but offsetting with increasing continuous claims

Initial jobless claims fell sharply by 23,000 to 206,000 in the week ending February 14, reversing the prior week’s jump and coming in below recent trends. The four-week moving average declined slightly to 219,000, suggesting layoffs remain contained despite some recent volatility. On a not-seasonally-adjusted basis, initial claims dropped by 42,509 (-17%), a much larger decline than seasonal factors had projected, reinforcing the view that the prior spike was likely transitory.

Continuing claims, however, increased modestly by 17,000 to 1.869 million in the week ending February 7, while the four-week average ticked up to 1.845 million. The insured unemployment rate remained steady at 1.2% (seasonally adjusted) and 1.4% (unadjusted), signaling limited deterioration in ongoing layoffs. Total continued claims across all programs fell by 9,081 to 2.239 million, remaining broadly in line with year-ago levels.

Regionally, the highest insured unemployment rates were concentrated in Rhode Island (3.0%), New Jersey (2.9%), and Massachusetts (2.7%). Larger weekly increases in claims were seen in Texas (+2,592), Virginia (+1,909), and California (+1,362), with state comments pointing primarily to layoffs in manufacturing and construction. Meanwhile, Pennsylvania, Missouri, Illinois, Wisconsin, and Michigan saw notable declines, largely tied to fewer construction and manufacturing layoffs.

Overall, the report suggests the labor market remains in a low-firing environment. Initial claims volatility over the past few weeks appears weather- or sector-driven rather than indicative of a broader weakening trend, while continuing claims remain relatively stable compared to 2025 averages.

United Kingdom’s unemployment rate rose to 5.2% in the three months, expectation 5.1%

02/21/2026 12:00 pm EST

AJ Economy Trend - United Kingdom Down due to rising unemployment rate to 5.2% in three months, consistently rising unemployment

The UK unemployment rate rose to 5.2% in the three months to December 2025, slightly above expectations and up from 5.1% previously, marking the highest level since early 2021. The number of unemployed increased by 94,000 quarter-on-quarter to 1.883 million, with gains recorded across short-term (up to 6 months), medium-term (6–12 months), and long-term (over 12 months) unemployment, suggesting a broad-based softening. Despite this, total employment rose by 52,000 to 34.244 million, though the employment rate edged down 0.1 percentage point to 75.0%, reflecting demographic and participation dynamics. The number of people holding second jobs slipped slightly to 1.287 million (3.8% of those employed). Meanwhile, the economic inactivity rate declined to 20.8%, as 38,000 fewer people were classified as inactive, bringing the total to 9.042 million. Overall, the data point to a cooling labour market, with rising unemployment occurring alongside modest employment growth and slightly improved participation dynamics.

Canada’s headline inflation rate eased to 2.3% in January of 2026

02/19/2026 12:00 pm EST

AJ Economy Trend - Canada Down due to high inflation rate even though the recent month shows easing of inflation pressure

The headline inflation rate in Canada eased to 2.3% in January of 2026 from the three-month high of 2.4% in the previous period, slightly under market expectations that it would hold at 2.4%. The result was loosely aligned with the Bank of Canada's projection that the inflation rate would be near the 2.5% mark at the start of the year before treading below the 2% target, as base effects from the GST/HST break in January of 2025 continued to impact annual inflation rates. Deflation picked up for transportation (-17% vs -0.5% in December) due to the 16.7% plunge in gasoline prices. Inflation slowed for shelter (1.7% vs 2.1%) and household operations and furnishings (2.5% vs 3.6%). In turn, prices accelerated for food (7.3% vs 6.2%) due to breaks from the tax regimes, especially lifting prices of food from restaurants (12.3%). Meanwhile, the trimmed-mean core rate fell to 2.4% from 2.7%, well under expectations of 2.6%, for the lowest since April 2021.

Core consumer inflation continued to ease in US to 2.5% year over year, but short-term stickiness persists

02/15/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to CPI moving towards 2% target set by Fed but rate cut hopes still remain uncertain

Core consumer price inflation in the U.S. eased to 2.5% year-over-year in January 2026, down from 2.6% in December and marking the lowest annual reading since March 2021, in line with market expectations. The moderation was driven largely by continued cooling in shelter costs, which slowed to 3.0% from 3.2%, alongside softer price gains in recreation (2.5% vs. 3.0%) and household furnishings and operations (3.9% vs. 4.0%). Medical care inflation held steady at 3.2%, while personal care prices accelerated notably to 5.4% from 3.7%, indicating some remaining pockets of pressure. On a monthly basis, however, core prices rose 0.3%, accelerating from 0.2% in December, suggesting that while the broader disinflation trend remains intact, underlying price momentum has not fully dissipated. Overall, the data reinforce the narrative of gradual progress toward the Federal Reserve’s 2% target, though short-term stickiness persists in certain service categories.

US nonfarm payrolls rose by 130,000 in January 2026, rebounding from a downwardly revised 48,000 gain

02/12/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to nonfarm payrolls increase by 130,000 in January 2026, but with consistent downward revision from the previous months

U.S. nonfarm payrolls rose by 130,000 in January 2026, sharply rebounding from a downwardly revised 48,000 gain in December and well above expectations of 70,000, marking the strongest monthly increase since December 2024. Job growth was concentrated in health care (+82K), particularly ambulatory health care services (+50K), along with solid gains in social assistance (+42K) and construction (+33K). Manufacturing also posted a modest increase of 5,000 jobs. Offsetting some of the strength, federal government employment declined by 34,000 as workers who accepted deferred resignation offers exited payrolls, and financial activities shed 22,000 positions. Employment was little changed across several major sectors, including retail trade, transportation and warehousing, professional and business services, leisure and hospitality, and information. Despite January’s upside surprise, the broader trend remains weak: total nonfarm employment growth for 2025 was revised down dramatically to 181,000 from 584,000, implying average monthly gains of just 15,000—far softer than the previously estimated 49,000 pace.

The NFIB Small Business Optimism Index edged down to 99.3 in January 2026

02/11/2026 12:00 pm EST

AJ Economy Trend - US Down due to small business optimism dropped further in January 2026

The NFIB Small Business Optimism Index edged down to 99.3 in January 2026 from 99.5 in December, missing expectations of 99.9 and signaling a modest pullback in sentiment. Of the ten index components, three improved while seven deteriorated. The most notable gain came from expected real sales volume, which jumped 6 points to a net 16%, marking the strongest shift within the survey. Concerns about labor quality eased, with 16% of owners citing it as their top problem, down three points from December. However, worries about insurance costs or availability climbed sharply, rising four points to 13%—the highest share since December 2018. Capital spending remained firm, with 60% of owners reporting capital outlays in the past six months, up four points and the highest since November 2023. Despite solid GDP growth, small businesses appear cautious, though more owners are reporting improved business conditions and stronger sales expectations, according to NFIB Chief Economist Bill Dunkelberg.

France’s unemployment rate rose to 7.9% in the fourth quarter of 2025, exceeding expectations

AJ Economy Trend - France Down due to significant increase in unemployment rate as labor engagement and unemployment pressures increased

France’s unemployment rate rose to 7.9% in the fourth quarter of 2025, exceeding expectations of 7.8% and up from 7.7% in Q3, marking its highest level since Q3 2021. The number of unemployed increased by 56,000 to 2.5 million, leaving the rate 0.6 percentage points higher than a year earlier, though still well below the 2015 peak. Youth unemployment deteriorated notably, with the 15–24 age group jumping 2.4 points to 21.5%, while joblessness among 15–29-year-olds rose to 16.0%. In contrast, unemployment fell slightly among those aged 25–49 (to 6.9%) and remained stable for workers aged 50 and over (5.1%). Gender dynamics diverged, as male unemployment rose to 8.1% while female unemployment edged down to 7.6%. Despite the uptick in joblessness, broader labor market metrics remained relatively firm: the employment rate for those aged 15–64 held near a record 69.4%, the full-time employment rate stayed at 57.5%, part-time employment ticked up to 11.8%, and the activity rate climbed to a record 75.4%, suggesting continued labor force engagement even as unemployment pressures increased.

US consumer sentiment rose 0.9 points to 57.3, remained 20% below a year earlier

02/06/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to constantly improving consumer sentiment but with concerns of job losses and longer run inflation expectations

US consumer sentiment continued to improve in February, with the University of Michigan index rising 0.9 points to 57.3—its third straight monthly gain and above expectations—but confidence remains roughly 20% below a year earlier. The uptick was driven mainly by households with significant stock market exposure, while sentiment among those without equities stayed subdued. Consumers reported modestly better views of their personal finances and buying conditions for durable goods, though longer-term business expectations softened slightly. Persistent concerns about high prices and potential job losses continue to weigh on attitudes. Notably, year-ahead inflation expectations dropped sharply to 3.5%, the lowest since January 2025, even as longer-run inflation expectations inched higher to 3.4%, underscoring a mixed outlook on price pressures.

Job Openings in the US dropped sharply by 386,000 in December 2025, lowest level since September 2020

02/06/2026 12:00 pm EST

AJ Economy Trend - US Down due to significant drop of job openings in the most recent job openings record

Job openings in the US dropped sharply by 386,000 to 6.54 million in December 2025, the lowest level since September 2020 and far below expectations of 7.2 million, signaling a marked cooling in labor demand. The decline was broad based, led by professional and business services, retail trade, and finance and insurance, while all major regions recorded fewer openings, with the steepest fall in the Northeast. Despite the contraction in vacancies, labor market flows remained relatively stable: hires and total separations both held at 5.3 million, quits were unchanged at 3.2 million, and layoffs and discharges stayed near 1.8 million. Overall, the data point to weakening hiring appetite rather than an acceleration in job losses.

Initial Jobless Claims in the US jumped by 22,000 to 231,000 in the final week of January, well above expectations of 212,000

02/05/2026 12:00 pm EST

AJ Economy Trend - US Down due to increase in initial jobless claims increase in the final week of January 2026

Initial jobless claims in the US jumped by 22,000 to 231,000 in the final week of January, well above expectations of 212,000 and marking the highest level in nearly two months, while continuing claims also rose by 25,000 to 1.84 million after previously falling to their lowest level since September 2024. The increase in claims was largely attributed to widespread winter storms that disrupted business activity across several regions, temporarily pushing more households to file for unemployment benefits. Despite the uptick, the data continue to support the broader picture of a labor market characterized by low layoffs and muted hiring momentum. Meanwhile, initial claims filed by federal employees declined by 230 to 568, easing concerns that the recent government shutdown was translating into a sustained rise in unemployment filings.

The Bank of England held Bank Rate at 3.75% in February to counter easing inflation pressures against a weakening economy

02/05/2026 12:00 pm EST

AJ Economy Trend - UK Down due to constantly deteriorating economy along with easing inflation pressures

The Bank of England held its Bank Rate at 3.75% in February, with a closely split 5–4 vote underscoring growing divisions within the Monetary Policy Committee as it weighed easing inflation pressures against a weakening economic backdrop. While inflation remains above the 2% target, policymakers expect it to fall back toward that level from April, helped in part by energy price developments. Softer pay growth and cooling services inflation point to rising slack in the labour market and subdued demand, reducing concerns about persistent inflation. With Bank Rate already cut by 150 basis points since August 2024, the committee judged policy to be less restrictive, noted increased downside risks to growth and employment, and signaled that further cuts are likely—though future decisions will remain finely balanced and data dependent.

Private-sector hiring in the US is slowing down sharply in January 2026, with businesses adding just 22,000 jobs

02/05/2026 12:00 pm EST

AJ Economy Trend - US Down due to steadily slowing down private sector hiring on the positions and it has been cooled over the past three years.

Private-sector hiring in the US slowed sharply in January 2026, with businesses adding just 22,000 jobs, well below expectations and down from a revised 37,000 gain in December. Job growth was narrowly concentrated, led by health care, which added a robust 74,000 positions, while financial activities, construction, trade, transportation and utilities, and leisure and hospitality posted modest gains. These increases were largely offset by sizeable losses in professional and business services, which shed 57,000 jobs, and manufacturing, which fell by another 8,000 and has now been contracting steadily since March 2024. Hiring momentum also diverged by firm size, with mid-sized companies (50–249 employees) adding 37,000 jobs, small firms showing no net change, and large employers cutting 18,000 positions. As ADP noted, job creation has cooled markedly over the past three years—private employers added just 398,000 jobs in 2025, about half the pace seen in 2024—even as wage growth has remained relatively stable.

ISM Manufacturing Employment Index improved in January 2026 but remained in contraction area

02/05/2026 12:00 pm EST

AJ Economy Trend - US Down due to ISM Manufacturing Employment Index remained within the contraction area under 50 threshold

The ISM Manufacturing Employment Index improved to 48.1 in January 2026 from 44.8 in December, but it remained firmly below the 50 threshold, signaling a continued contraction in factory payrolls. This marked the 28th straight month of declining manufacturing employment, underscoring the depth and persistence of the downturn, with job losses recorded in 36 of the past 37 months since January 2023. Hiring gains were limited, with only Transportation Equipment and Computer & Electronic Products reporting net increases in staffing. Overall, manufacturers continued to cut jobs, with mentions of workforce reductions outnumbering hiring plans by roughly two to one, as firms remain cautious amid uncertain demand. At the industry level, only five of 18 sectors added workers, while eleven reported declines, led by textiles, apparel, wood products, and energy-related manufacturing.

France’s economy grew 0.2% quarter over quarter in Q4 2025, slowed down from 0.5% in Q3 2025

02/01/2026 12:00 pm EST

AJ Economy Trend - France Down due to slow down of quarter over quarter growth in Q4 2025

France’s economy grew 0.2% quarter over quarter in Q4 2025, slowing from 0.5% in Q3 and matching market expectations, according to flash estimates, marking the weakest pace of expansion in three quarters. The deceleration reflected softer domestic demand, as government consumption growth cooled to 0.3% from 0.7% and fixed investment slowed sharply to 0.2% from 0.7%, led by weaker spending on transport equipment, capital goods, and construction. Inventories continued to be a significant drag, subtracting around 1.0 percentage point from growth, underscoring cautious business behavior. By contrast, household consumption accelerated to 0.3% from 0.1%, supported by firmer goods spending and sustained momentum in services consumption. External trade was the main growth offset, with net exports contributing a sizable 0.9 percentage point, as imports fell 1.7% after rising in Q3, more than compensating for a sharp slowdown in export growth to 0.9% from 3.2%. On a year-over-year basis, GDP rose 1.1%, up from 0.9% in Q3 but slightly below expectations of 1.2%, nonetheless marking the strongest annual expansion in five quarters and highlighting the economy’s continued, though uneven, resilience in France.

Japan’s unemployment rate was unchanged at 2.6% in December 2025, extending a four month plateau

01/30/2026 12:00 pm EST

AJ Economy Trend - Japan Neutral due to unemployment remain unchanged, demonstrating healthy labor market demand

Japan’s unemployment rate was unchanged at 2.6% in December 2025, extending a four-month plateau and remaining the highest since July 2024, yet still low by historical standards. The number of unemployed increased 50,000 to 1.86 million, while employment declined by 50,000 to 68.46 million, reflecting a parallel 50,000 drop in the labor force to 70.31 million rather than a rise in layoffs. Consistent with that dynamic, the population outside the labor force rose 50,000 to 39.27 million, highlighting demographic and participation effects rather than labor-market stress. The labor force participation rate slipped to 63.9% from 64.1% in November but remained 0.5 percentage point above year-earlier levels, signaling a still-elevated engagement trend versus 2024. Importantly, job matching conditions improved modestly, with the jobs-to-applicants ratio edging up to 1.19 from a near three-year low, beating expectations of 1.18 and indicating that available positions continue to exceed job seekers. Overall, the data point to a labor market that is cooling at the margin but remains structurally tight, with movements driven more by participation shifts than by rising unemployment pressure in Japan.

Initial unemployment claims fell slightly to 209,000 in the week ending January 24, with improvement of insured unemployment

01/30/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to improvement of seasonally adjusted insured unemployment declining and slight fall in initial unemployment claims in the week of January 24

Seasonally adjusted initial unemployment claims fell slightly to 209,000 in the week ending January 24, down 1,000 from the prior week, while the four-week moving average rose to 206,250, up 2,250, but remained close to its lowest level in a year. Continuing claims showed a clearer improvement, with seasonally adjusted insured unemployment declining by 38,000 to 1.827 million, the lowest level since September 21, 2024, and the four-week average falling to 1.867 million. The insured unemployment rate held steady at 1.2%, underscoring limited slack at the margin. On a non-seasonally adjusted basis, initial claims dropped sharply by 41,255 to 231,181, while insured unemployment fell 82,168 to 2.15 million, both outperforming seasonal expectations. Total continued claims across all programs decreased by 69,868 to 2.27 million, now slightly below year-ago levels. Regionally, the highest insured unemployment rates were reported in Rhode Island (2.9%), New Jersey (2.8%), Massachusetts (2.7%), and Washington (2.7%), while the largest weekly increases in initial claims occurred in California (+5,504) and Kentucky (+2,817), offset by notable declines in New York (-9,464) and Texas (-4,440). Taken together, the data reinforce the narrative of a labor market that remains tight, with layoffs subdued and continuing claims trending lower, even as weekly volatility persists.

Metropolitan Capital Bank And Trust of Chicago was closed on January 30th 2026

01/30/2026 12:00 pm EST

AJ Economy Trend - US Down due to Bank Failures starting to appear in the market

Metropolitan Capital Bank & Trust of Chicago was closed on January 30, 2026, by the Illinois Department of Financial and Professional Regulation, with the FDIC appointed as receiver. The FDIC entered into a purchase-and-assumption agreement with First Independence Bank of Detroit, which will assume substantially all of Metropolitan Capital Bank & Trust’s deposits and purchase about $251 million of its assets. The bank’s sole office will reopen as a branch of First Independence Bank on February 2, 2026, during normal business hours. Depositors will automatically become customers of First Independence Bank, with all assumed deposits remaining fully insured by the FDIC and accessible without interruption through checks, ATMs, and debit cards. As of September 30, 2025, Metropolitan Capital Bank & Trust reported $261.1 million in assets and $212.1 million in deposits. The FDIC will retain the remaining assets for later disposition and estimates the failure will cost the Deposit Insurance Fund approximately $19.7 million. This marks the first U.S. bank failure of 2026.

The Bank of Canada left its overnight rate unchanged at 2.25% at its January 2026 meeting

01/30/2026 12:00 pm EST

AJ Economy Trend - Canada Neutral due to overnight rate being unchanged to maintain the current economic condition

The Bank of Canada left its overnight rate unchanged at 2.25% at its January 2026 meeting, in line with market expectations and prior guidance, judging the current policy stance to be appropriate given its baseline economic outlook. While the central bank largely reaffirmed the projections from its October Monetary Policy Report—expecting GDP growth of just over 1% in 2026 and around 1.5% in 2027, with inflation remaining close to the 2% target—it emphasized elevated uncertainty stemming from renewed U.S. tariff threats. Policymakers warned that potential trade disruptions could materially affect the outlook and said monetary policy may need to be adjusted in either direction should risks intensify, even as trade-related cost pressures are currently expected to be offset by excess supply in the economy.

ADP National Employment Report in December 2025 showed modest rebound in US private-sector hiring

01/28/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to rebound of private sector hiring even facing high interest rate environment and difficult for business borrowing

The December 2025 ADP National Employment Report showed a modest rebound in U.S. private-sector hiring, with payrolls rising by 41,000 after a revised 29,000 decline in November. Job gains were concentrated in service-providing industries, particularly education and health services and leisure and hospitality, while goods-producing sectors recorded a small net decline led by manufacturing losses. Hiring dynamics diverged by firm size, as small and medium-sized businesses added jobs and recovered from November weakness, but large employers saw only marginal gains. Regionally, job growth was strongest in the South and Northeast, offset by sizable losses in the West. Wage growth remained steady for job-stayers at 4.4% year over year, while pay gains for job-changers accelerated to 6.6%, indicating continued tightness in certain segments of the labor market despite overall subdued job creation.

Japan’s leading economic index rose to 110.5 in November 2025 from 109.8 in October

01/24/2026 12:00 pm EST

AJ Economy Trend - Japan Neutral due to improving leading economic index rose to 110.5 in November 2025

Japan’s leading economic index rose to 110.5 in November 2025 from 109.8 in October, beating market expectations and reaching its highest level since May 2024, signaling an improving outlook for the months ahead. The increase was driven largely by stronger consumer sentiment, which climbed to an 18-month high, alongside a labor market that continued to show resilience, with employment hitting a fresh record despite the unemployment rate holding steady at 2.6%. While cost pressures are still expected to persist toward year-end, the broader data suggest that household spending is gradually recovering, pointing to a modest but ongoing improvement in Japan’s economic momentum.

Bank of Japan held its key short-term policy rate steady at 0.75% at its first meeting of 2026

01/23/2026 12:00 pm EST

AJ Economy Trend - Japan Neutral due to high short term interest rates to maintain the high interest rates to keep inflation under control

The Bank of Japan held its key short-term policy rate steady at 0.75% at its first meeting of 2026, keeping borrowing costs at their highest level since September 1995 ahead of February’s snap election. The widely expected decision passed by an 8–1 vote, with board member Hajime Takata dissenting in favor of a hike, while the majority judged risks to growth and inflation to be broadly balanced. Policymakers reiterated that further rate increases remain possible, following two hikes in 2025, should economic activity and inflation track their projections. In its updated quarterly outlook, the BoJ revised up its FY 2025 GDP growth forecast to 0.9% from 0.7%, citing support from a recent trade deal with Washington and a sizable fiscal stimulus package that includes energy subsidies, expanded local government grants, and higher defense spending. The FY 2026 growth outlook was also raised to 1.0% from 0.7%, alongside a slight upward revision to the FY 2026 core inflation forecast to 1.9%.

US initial jobless claims remained low in mid-January, showing continued labor market resilience

01/23/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to consumer sentiment index revised higher to 56.4 in January 2026, marking slight improvements from December’s 52.9

The University of Michigan’s consumer sentiment index was revised higher to 56.4 in January 2026, up from a preliminary 54.0 and December’s 52.9, marking the second consecutive monthly improvement and the strongest reading since August. Gains were modest but broad-based, spanning all major components of the survey as well as income, education, age, and political groups. Despite the improvement, overall sentiment remains more than 20% below its level a year earlier, underscoring persistent caution among households. Consumers continue to point to strained purchasing power from elevated prices and rising concern about a potential softening in labor market conditions, while foreign developments appear to have little impact on their outlook beyond tariff-related issues. Notably, year-ahead inflation expectations eased to 4.0%, the lowest since January 2025, even as longer-run inflation expectations edged slightly higher to 3.3%.

US initial jobless claims remained low in mid-January, showing continued labor market resilience

01/22/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to stable initial jobless claims in mid January despite slight increase in the insured unemployment

U.S. initial jobless claims remained low in mid-January, pointing to continued labor market resilience. For the week ending January 17, seasonally adjusted initial claims edged up slightly by 1,000 to 200,000, while the four-week moving average fell to 201,500, its lowest level since mid-January 2024. Insured unemployment held steady at 1.2% for the week ending January 10, and the number of continuing claims declined by 26,000 to 1.85 million, with the four-week average also trending lower. On an unadjusted basis, initial claims dropped sharply by more than 71,000 following seasonal distortions earlier in the month, broadly in line with expectations. Total continued claims across all programs increased modestly, reflecting some persistence in benefit durations, while no states triggered extended benefits. Overall, the data suggest limited layoffs and stable labor market conditions despite regional volatility and ongoing adjustments in federal and veteran-related claims.

NFIB Small Business Optimism Index rose for a second straight month to 99.5 in December 2025

01/15/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to increasing optimism of NFIB Small Business Optimism Index but weakening forward-looking indicators

The NFIB Small Business Optimism Index rose for a second straight month to 99.5 in December 2025, its highest reading since August and slightly above its 52-year average of 98, supported mainly by a sharp improvement in expectations for business conditions, with the net share of owners anticipating better conditions jumping 9 points to 24%. Profit trends showed modest improvement, with the net balance rising 3 points to -20%, while assessments of current business health were mixed, as 9% of owners rated conditions as excellent, 54% as good, 34% as fair, and 3% as poor. Despite the firmer headline sentiment, forward-looking indicators weakened, with plans for hiring, capital spending, and expectations for higher real sales all declining. Taxes emerged as the most significant concern, cited by 20% of respondents—up 6 points from November and the highest share since May 2021—while overall uncertainty eased notably, with the Uncertainty Index falling 7 points to 84, its lowest level since June 2024.

U.S initial jobless claims fell by 9,000 to 198,000, with continuous unemployment and insurance edged down

01/15/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to stabilized initial jobless claims number and stable continuous unemployment and insurance number

U.S. unemployment insurance data for the week ending January 10 pointed to continued resilience in the labor market, with seasonally adjusted initial claims falling by 9,000 to 198,000, while the four-week moving average declined to 205,000—its lowest level since January 2024. Continuing claims also eased, as insured unemployment fell by 19,000 to 1.884 million and the insured unemployment rate remained unchanged at 1.2%, suggesting limited layoff pressure. In contrast, unadjusted data reflected expected post-holiday volatility, with initial claims rising by nearly 32,000 and insured unemployment increasing as seasonal effects unwound. Continued weeks claimed across all programs climbed to about 2.22 million, driven largely by seasonal factors rather than a clear deterioration in underlying labor-market conditions.

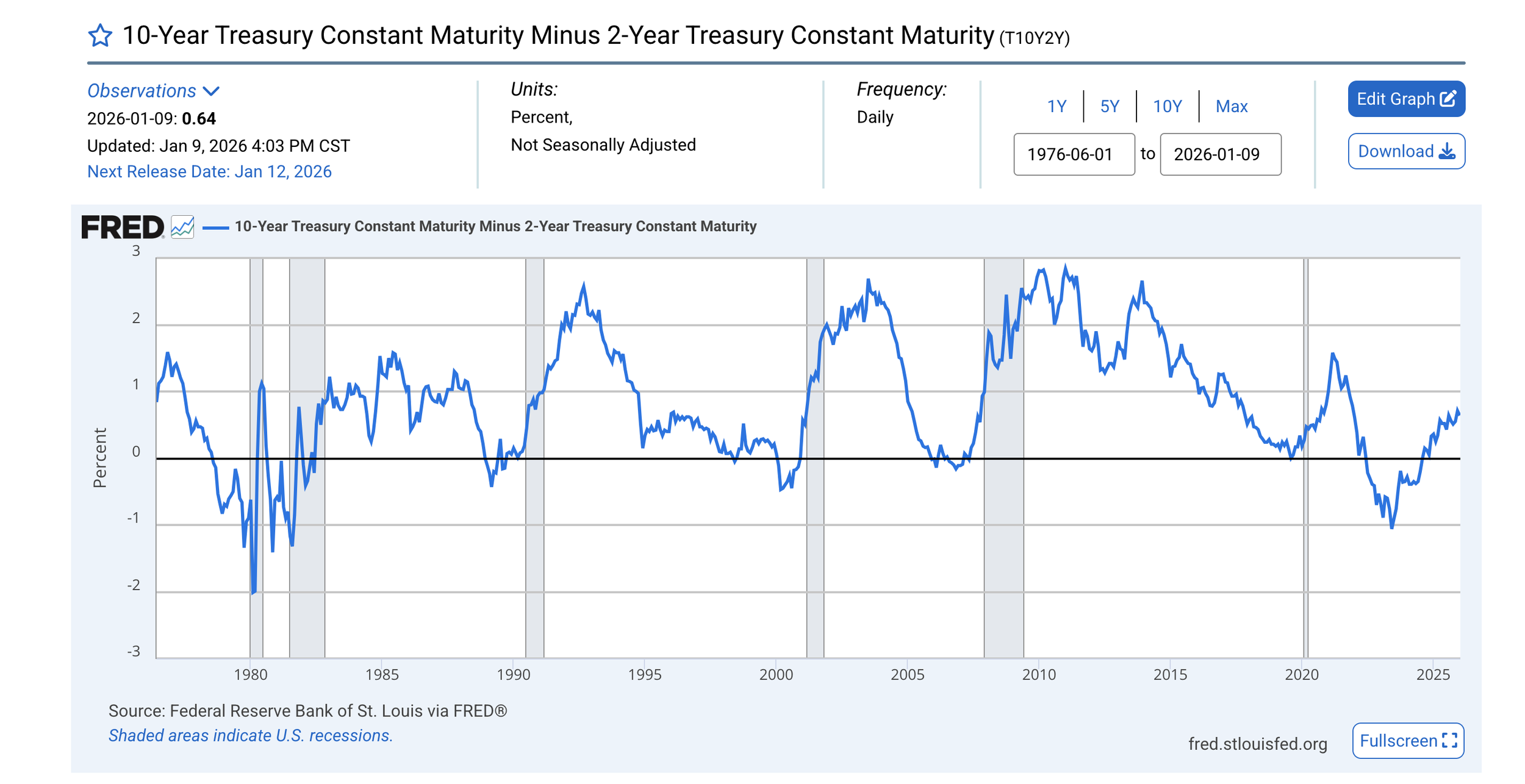

10-year minus 2-year Treasury yield spread turned positive after the longest inversion in history

01/10/2026 12:00 pm EST

AJ Economy Trend - US Down due to concerns of financial instability due to long period of interest rate inversion

The 10-year minus 2-year Treasury yield spread turned positive to about 0.64 percentage points as of early January 2026, marking a clear re-steepening of the curve after the prolonged inversion seen during 2022–2024. That earlier inversion reflected aggressive Federal Reserve tightening and strong recession signals, while the recent move back into positive territory suggests markets are increasingly pricing in easier monetary policy ahead, with short-term yields declining faster than long-term rates. Historically, recessions tend to occur during or shortly after inversions, whereas the re-steepening phase often aligns with late-cycle slowing or the early stages of policy easing rather than the start of a robust expansion. As a result, the current modestly positive slope points to reduced near-term financial stress but does not yet signal a strong growth rebound, especially given ongoing labor-market cooling and lingering inflation uncertainty.

University of Michigan’s consumer sentiment index edged higher, although concerns of inflation still impact consumers

01/09/2026 12:00 pm EST

AJ Economy Trend - US Down due to concerns of prices and consumer sentiments still linger with the impact of high inflation.

The University of Michigan’s consumer sentiment index edged higher for a second straight month, rising to 54.0 in January 2026—its highest reading since September 2025 and slightly above expectations—reflecting a modest improvement in household economic perceptions. The gains were driven largely by lower-income consumers, while sentiment among higher-income households softened. Despite the recent uptick, overall sentiment remains about 25% below its level a year earlier, underscoring persistent concerns about elevated prices and a cooling labor market, even as worries about tariffs have begun to ease. Short-term inflation expectations were unchanged at 4.2%, the lowest since early 2025 but still well above year-ago levels, while long-term inflation expectations edged up to 3.4%, hinting at lingering inflation unease among consumers.

U.S. unemployment rate edged lower to 4.4% in December 2025, coming in below expectations, payroll growth slowed to 50,000

01/09/2026 12:00 pm EST

AJ Economy Trend - US Down due to revised rising unemployment rate and slowdown of payroll growth to just 50,000 jobs. 2025 delivered the weakest annual employment gain since 2003.

The U.S. unemployment rate edged lower to 4.4% in December 2025, coming in below expectations and retreating from November’s four-year high, signaling tentative stabilization in labor market conditions. The improvement was driven by a sizable drop in the number of unemployed alongside solid employment gains, even as the labor force contracted slightly and participation ticked down. Importantly, broader labor market slack also eased, with the U-6 unemployment rate falling to its lowest level in several months. Overall, the data suggest that while hiring momentum remains uneven and participation has softened, pressures in the labor market are no longer intensifying and may be beginning to ease at the margin.

The December jobs report pointed to a markedly softer labor market backdrop, with payroll growth slowing to just 50,000 jobs and confirming that 2025 delivered the weakest annual employment gain since 2003. While the unemployment rate edged down to 4.4%, the modest improvement in joblessness contrasts with the pronounced slowdown in hiring momentum over the past

Canada’s unemployment rate edged up to 6.8% in December 2025, exceeding expectations

01/09/2026 12:00 pm EST

AJ Economy Trend - Canada Down due to rising unemployment rate and showing slowdown of economy

Canada’s unemployment rate edged up to 6.8% in December 2025, exceeding expectations, as a surge of new labor market entrants outweighed modest job gains. The increase partly reversed the notable declines seen over the previous two months, reflecting stronger participation rather than outright job losses. While employment continued to improve for a fourth consecutive month—driven by a solid rise in full-time positions—this was offset by a sharp drop in part-time work. Overall, the data point to a labor market that is still adding jobs but facing renewed slack as improved confidence draws more people back into the workforce.

Private sector employment rebounded by 41,000, fell short of expectations of 47,000 increase

01/08/2026 12:00 pm EST

AJ Economy Trend - US Down due to increase falling short from expectation and hiring concentration is not in business, information and manufacturing but education and health

Private sector employment in the U.S. rebounded by 41,000 jobs in December 2025, recovering from a revised 29,000 decline in November, though the gain fell slightly short of expectations for a 47,000 increase. Hiring was concentrated in services, led by education and health services (+39K) and leisure and hospitality (+24K), alongside moderate gains in trade, transportation and utilities, financial activities, and construction. These increases were partly offset by continued job losses in professional and business services, information, and manufacturing, highlighting uneven momentum across sectors. By firm size, small businesses returned to modest growth, medium-sized firms drove most of the gains, and large firms added very few jobs. Wage dynamics remained mixed: pay growth for job-stayers held steady at 4.4% year over year, while job-changers saw faster wage gains at 6.6%, signaling persistent competition for labor in select areas despite overall subdued hiring conditions.

Initial jobless claims rose modestly to 208,000 in the week ending January 3rd, continuing claims rise

01/08/2026 12:00 pm EST

AJ Economy Trend - US Down due to rising initial jobless claims and higher continuing claims, with insured unemployment rising to 1.91million

Initial jobless claims rose modestly to 208,000 in the week ending January 3, up 8,000 from the prior week, but remained at levels consistent with a still-resilient labor market. Notably, the four-week moving average fell to 211,750, its lowest reading since April 2024, highlighting the ongoing absence of a sustained pickup in layoffs. At the same time, continuing claims ticked higher, with insured unemployment rising to 1.91 million and the insured unemployment rate holding at 1.2%, suggesting that while layoffs remain limited, reemployment is taking somewhat longer. Unadjusted data showed larger seasonal increases typical for early January, including a jump in state insured unemployment, but year-ago comparisons were broadly stable. Overall, the report points to low firing activity alongside gradually softening labor-market turnover, consistent with a cooling—but not deteriorating—employment backdrop.

The employment gauge of the ISM Manufacturing PMI edged up to 44.9 in December 2025

01/06/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to ISM Manufacturing PMI climbed slightly but still remained under the historical average of 50.1

The employment gauge of the ISM Manufacturing PMI edged up modestly to 44.9 in December 2025 from 44.0 in November, but it remained firmly in contraction territory, marking a tenth consecutive month below the 50 threshold. Despite the slight improvement, the reading underscores continued weakness in manufacturing labor demand, with firms still prioritizing headcount management over hiring amid elevated costs and uncertain demand.

Historically, the index has averaged about 50.1 since 1950, highlighting how subdued current conditions remain relative to long-term norms, even though the latest reading is well above the extreme lows seen during past downturns.

Japan’s S&P Manufacturing PMI rose to 49.7 in December 2025, highest reading since August

01/04/2026 12:00 pm EST

AJ Economy Trend - Japan Neutral due to better manufacturing number in November, signaling ease of manufacturing downturn

The S&P Global Japan Manufacturing PMI rose to 49.7 in December 2025, up from 48.7 in November and above expectations, marking its highest reading since August and signaling that the manufacturing downturn is beginning to ease. Demand conditions improved, with goods demand contracting at the slowest pace in around 18 months, although export orders continued to fall amid weak external demand. Employment expanded, reflecting firmer domestic demand conditions, while the decline in unfinished work softened to an 18-month low, suggesting stabilization in production pipelines. On the inflation front, input cost pressures intensified, with operating cost inflation accelerating to its strongest pace in eight months. Looking ahead, business confidence remained constructive, with manufacturers expecting output to grow through 2026, supported by anticipated demand improvements, new product launches, and expansion into new markets.